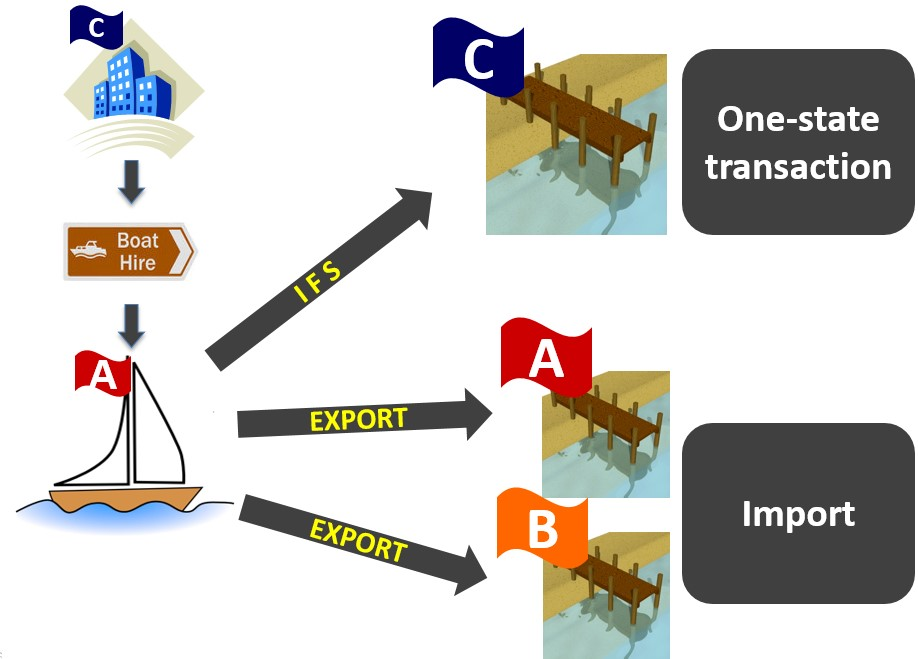

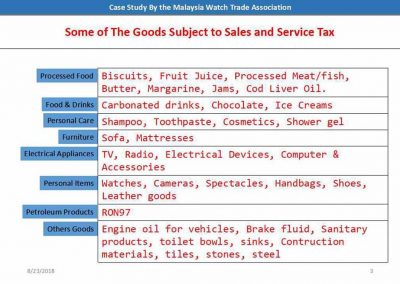

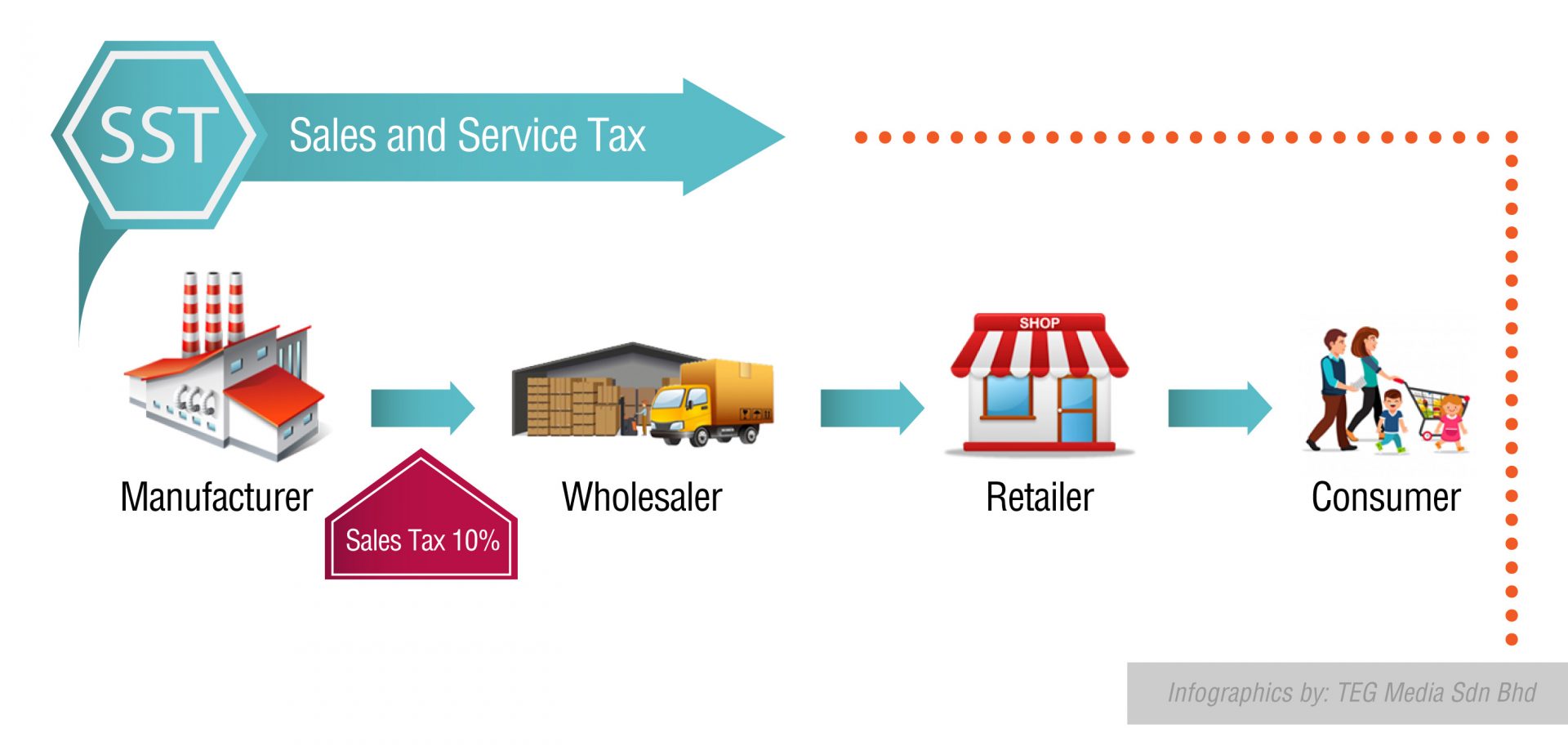

The Sales Tax is levied at the import or manufacturing levels and companies with a sales value of taxable goods exceeding RM500000 in a 12-month period are liable to be. However SST works separately as Sales Tax and Service Tax.

Merge By Rhb Reintroduction Of Sst

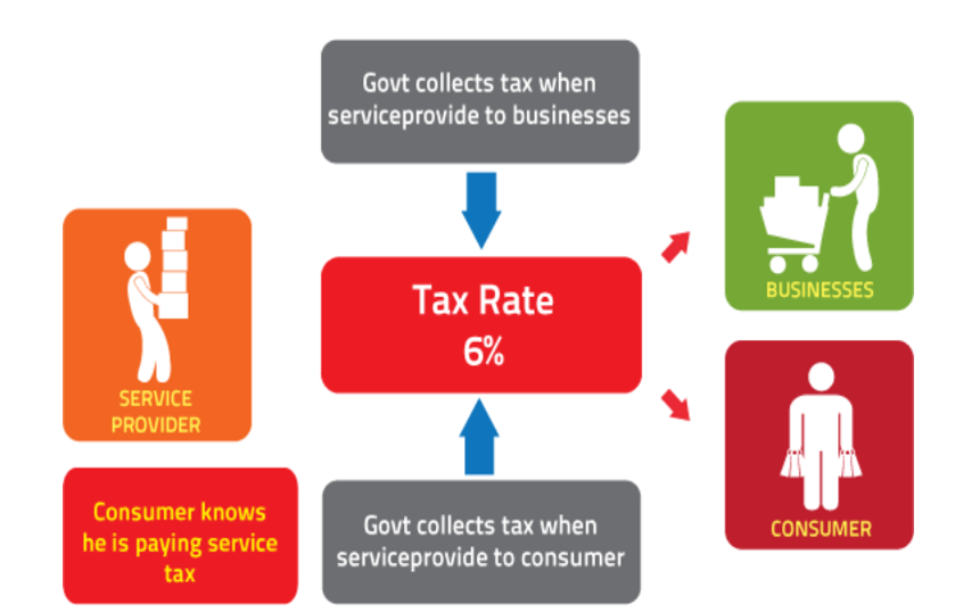

Both taxes are single-stage taxes whereby the sales tax Sales Tax Act 1972 is typically charged at the manufacturers level while the service charge or tax Service Tax Act.

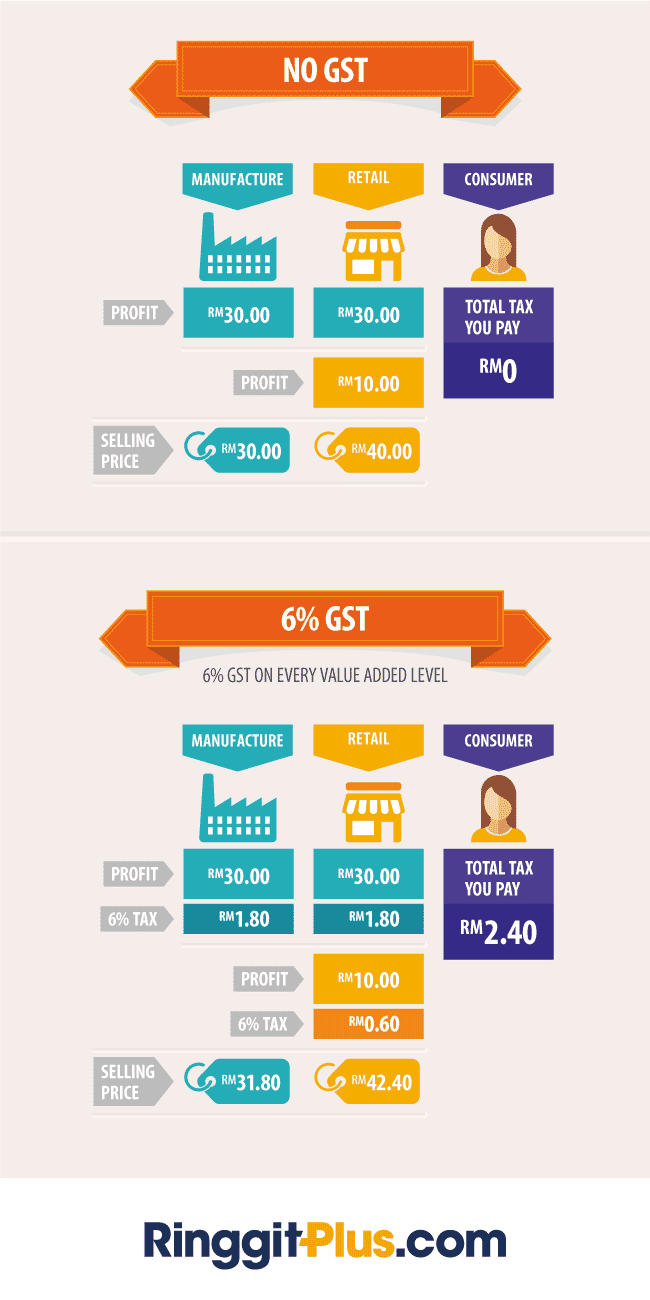

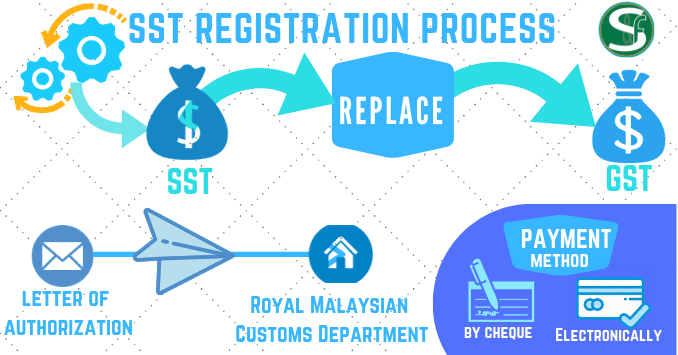

. Two components of the SST are charged and levied. Transition from GST 6 to 0 and then to SST. The SST replaces the existing Goods and Services Tax GST and affects all domestic and import shipments.

Before the 6 GST that was. Sales and Service Tax commonly known as SST is the new tax in Malaysia that was implemented on 1 September 2018. From 1 September 2018 the Sales and Services Tax SST will replace the Goods and Services Tax GST in Malaysia.

Currently stands at 325. It replaced the Goods and Services Tax GST which was. Broad-based levied on all goods and services including imports unless specifically.

This website is developed to enable the public to access information related to the Royal Malaysian Customs Department includes corporate information organization and. The new sales tax will be imposed at a rate of either 5 10 or a specific amount will be for petroleum products. The move of scrapping the 6 GST has paved the way for the re-introduction of SST 20 which will come into effect in 1 September 2018.

Sales tax a single-stage tax imposed on taxable goods manufactured locally and sold by a registered manufacturer and on taxable goods imported. Tax rate 6 to 0. Goods and Services Tax GST Sales and Service Tax SST Multi-stage tax.

The SST consists of 2 elements. Sales and Service Tax SST is a tax charged and levied on taxable services provided by the taxable person. Submission of GST -03.

Service tax that is a tax charged and levied on taxable services provided by any taxable person in Malaysia in the course and furtherance of business. Here are the details on how the SST works - the. Rate could go up to 35 in the whole of 2019.

The service tax rate will be. Malaysias new Sales and Service Tax or SST officially came into effect on 1 September replacing the former Goods and Services Tax GST system and requiring. Sales tax and service tax which we will be mentioning later in the article.

Sales and service tax SST has been doing well in Malaysia before it was replaced a few years back. Goods will be taxed between 5 and 10 under the new. The Sales and Service Tax SST is made up of two main taxes.

THERE has been plenty of talk recently in relation to the Goods and Services Tax GST and the Sales and Service Tax SST and what the impact of each is to the consumers. The Sales and Services Tax SST has been implemented in Malaysia. It stands for 10.

SST in Malaysia and How It Works. A service tax on taxable services provided by any taxable person in Malaysia in the course and furtherance of business. A What is Service Tax.

The SST is replacing GST as part of a fiscal reform initiative by Malaysias new federal government Pakatan Harapan which took over in May 2018 after winning the 14th General.

Comparing Sst Vs Gst What S The Difference Comparehero

Sales And Service Tax Malaysia 2020 Onward Sst Malaysia

Gst To Sst In Malaysia 3 Key Impacts Explained Infographic

Malaysia Sst Sales And Service Tax A Complete Guide

Gst Vs Sst In Malaysia Mypf My

Malaysia Sst Sales And Service Tax A Complete Guide

Gst Vs Sst In Malaysia Mypf My

Malaysia Sales And Services Tax Sst Mwta

What Is Sst Its Impact Datatree Solutions

Gst Vs Sst Which Is Better Pressreader

Sst Vs Gst How Do They Work Expatgo

What Is Gst Goods And Services Tax Or Gst Is A Consumption Tax Based On Value Added Concept Unlike The Present Sales Tax Or Service Tax Which Is A Single Stage Tax Gst Is A Multi Stage Tax Payment Of Tax Is Made In Stages By Intermediaries In The

What Is Gst Goods And Services Tax Or Gst Is A Consumption Tax Based On Value Added Concept Unlike The Present Sales Tax Or Service Tax Which Is A Single Stage Tax Gst Is A Multi Stage Tax Payment Of Tax Is Made In Stages By Intermediaries In The

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Malaysia Sst Sales And Service Tax A Complete Guide

Sst Vs Gst How Do They Work Expatgo